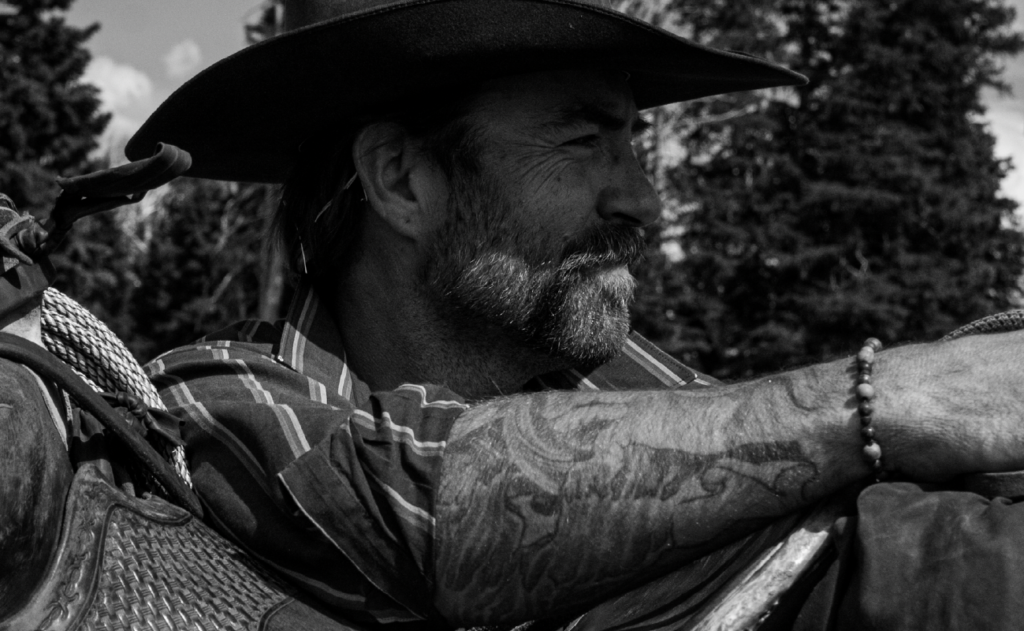

Congratulations to Co-op Members Sam Bowers and Mike Garrett on their 2022 RLI Appointments!

The REALTORS® Land Institute recently announced their 2022 leadership.

Land Broker Co-op Member Sam Bowers, ALC, was elected National Vice President; and Land Broker Co-op Member Mike Garrett, ALC, was elected At-Large Director.